When we consider all of the stressors in our lives, financial concerns are often near the top. Money worries can cost you sleep, affect your self-perception and confidence, and often result in denial and a kind of mental paralysis that can cause the problems to worsen, while not making you feel better at all. And then there’s the issue of shame – we all know that we’re supposed to live within our means, avoid debt, and constantly strive to “put money away” for a rainy day or for retirement. When we feel like we’re not achieving the goals that we’ve set for ourselves, we get discouraged and stressed.

Here are a few things you can do to relieve money stress.

Acknowledge the Problem

Financial problems don’t just go away. Ignoring a creditor’s phone calls isn’t effective in the long term, and only leads to more stress and bigger problems. Resolve to face the problems right away, and make an action plan.

Take Action

Do something about your situation right away. No matter how bad the problem is, there are steps you can take to prevent it from getting worse. Find out what they are, and take them as soon as possible. If you don’t know what to do, consider seeking help. (Read “Seek Help” below).

Don’t Let Money Problems Shame You

Many people experience, at one time or another, financial difficulties. Money troubles don’t mean you’re a failure and are far more common than you think. Don’t compare your situation to other people’s. Your neighbours might appear to be prosperous, but might be drowning in debt you can’t imagine. Make financial decisions that fit your life.

Seek Help

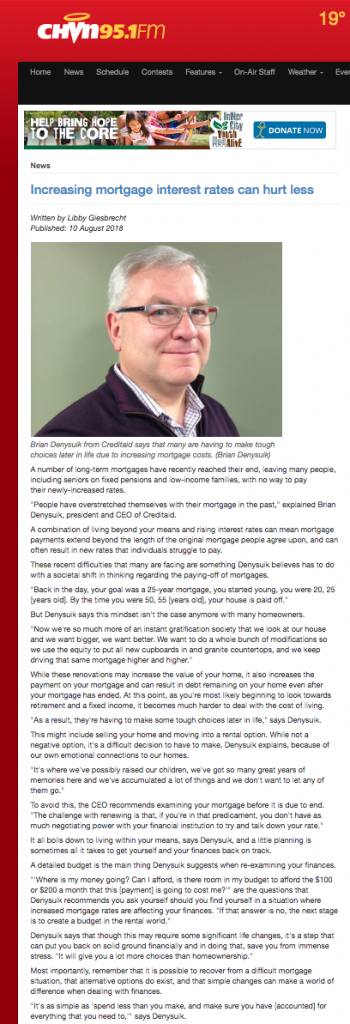

Financial difficulties can be complex and confusing. Luckily, you don’t have to go it alone. Creditaid has been helping Manitobans manage and overcome their debt for more than a quarter century. We provide credit counselling, budgeting, and other solutions that can help you restore your finances and rebuild your credit. Take the first step toward a secure, debt-free future. Contact Creditaid today for a free, no-obligation consultation.